Table of Contents

Background

The year 2020 has started out with many global and local events that people and businesses have not expected – COVID19, a change of government, and oil price dropping significantly to about $35 a barrel. Among all these, COVID-19 has probably impacted businesses the most in the past 3 months.

In addition to that, on March 18 2020 (Wednesday), the Malaysian government imposed a Movement Control Order (MCO), that required everyone to stay home, with strictly no travelling; and non-essential business premises are ordered to close. This has greatly impacted the Malaysian Small and Medium Enterprise (SME).

Malaysia’s SMEs are the backbone of the economy, contributing 38.3% to GDP and 5.7 millions jobs (70% of Malaysia’s employment). This survey intends to gather the sentiments of the service-based SMEs in Malaysia, the change in sentiment before and after the MCO was implemented, along with the actions they have taken and plan to take to counter the impact of COVID-19 and the MCO.

Two surveys were taken at different times – the first was Before the movement control order (MCO) was enacted on 18 march 2020, and the second round One Week into the MCO.

Survey Highlights

- Service-based SMEs in Malaysia who were already feeling the negative business impact of COVID-19 were affected even further by the MCO

- 68.9% of SMEs suffered a more than 50% drop in business within 1 week after the MCO started

- 80% of SMEs cited sales and cash flow as the main area affected by COVID-19

- 60% of SMEs had a negative outlook for their business for the rest of 2020. This number increased to 77.7% one week after the MCO started

- 92.5% of SMEs now have a negative outlook for Malaysian economy for the rest of 2020

- Majority of SMEs plan to use better hygiene practices, workplace disinfecting, and work from home policies as strategies to maintain business operations, but a worrying 10-15% of them are considering to reduce or re-deploy their staff. Some are also starting to have fatalistic views, citing “It’s out of my control”

- SMEs have strong hopes the government will provide aid in terms of reducing taxes and assisting the employees that will be re-deployed or removed.

1. How Businesses Have Been Impacted

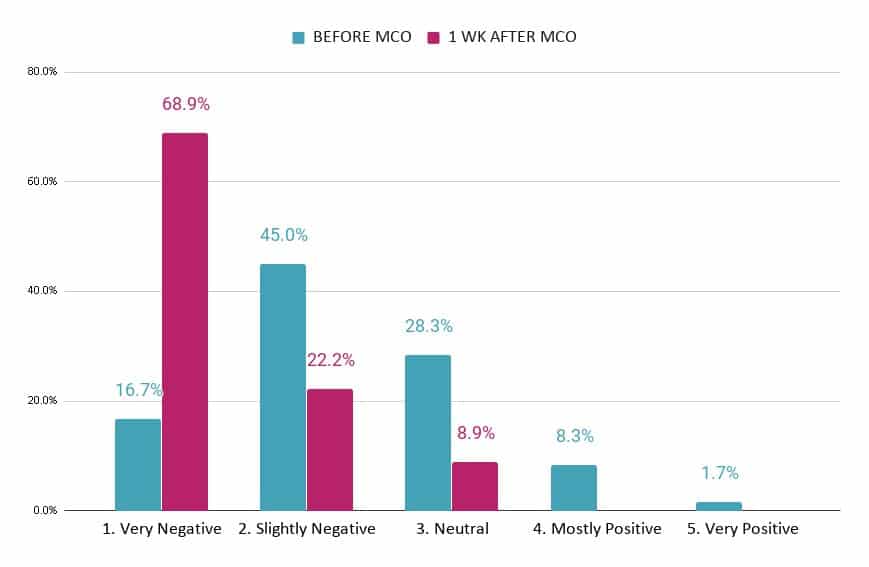

Before the MCO

SMEs were already feeling the pinch. The majority 61.7% of businesses have been impacted negatively in the past 3 months due to the outbreak. Many experienced a drop in incoming job requests, as well as cancellation of existing leads. Some of the comments are as stated:

- “Fewer requests coming in for needs of service”

- “Customers are cancelling because the situation is getting worse”

- “Homeowners are reconsidering their home projects to reduce the spending”

- “Clients are concerned to meet face to face”

A considerable fraction of 28.3% responded neutral, indicating that their companies weren’t being affected. For them, business continues as usual, as stated in the following comments:

- “Just enough to survive”

- “Business is a usual, and project are still ongoing”

Only 10% expressed that business has been impacted positively. Very few industries have found a vantage point out of the outbreak to boost up sales.

One Week Into the MCO

91.1% of SMEs reported a negative impact to their business. Reasons vary from a reduction in demand, cancellations of projects, and travel or entry restrictions imposed for the MCO.

- “Customers cancelled the jobs because there was no clear direction whether my business was allowed to operate”

- “Project requests have slowed down. Even projects that were originally confirmed are now being rescinded due to budget cuts, or cancelled because we’re now unable to meet the client’s timeline since we’re forced to close the workshop”

- “Site visits are put on hold”

- “We get jobs but service providers are not authorized to enter certain premises”

- “Suppliers are closed”

“Project requests have slowed down. Even projects that were originally confirmed are now being rescinded due to budget cuts, or cancelled because we’re now unable to meet the client’s timeline since we’re forced to close the workshop”

Survey respondent

At the same time, supplies are running out due to shops temporarily closing which in turn disrupts the SME’s ability to complete jobs.

- “I’m a technician. All the spare part shops are closed, and I can’t go out at all for work”

- “Owners are becoming slow to decide. Even our quoted prices are getting lower and lower”

- “Work progress is slow because we can only communicate online and not face to face”

- “Payments stuck; less projects around; more price competition”

2. Area of Business Most Impacted

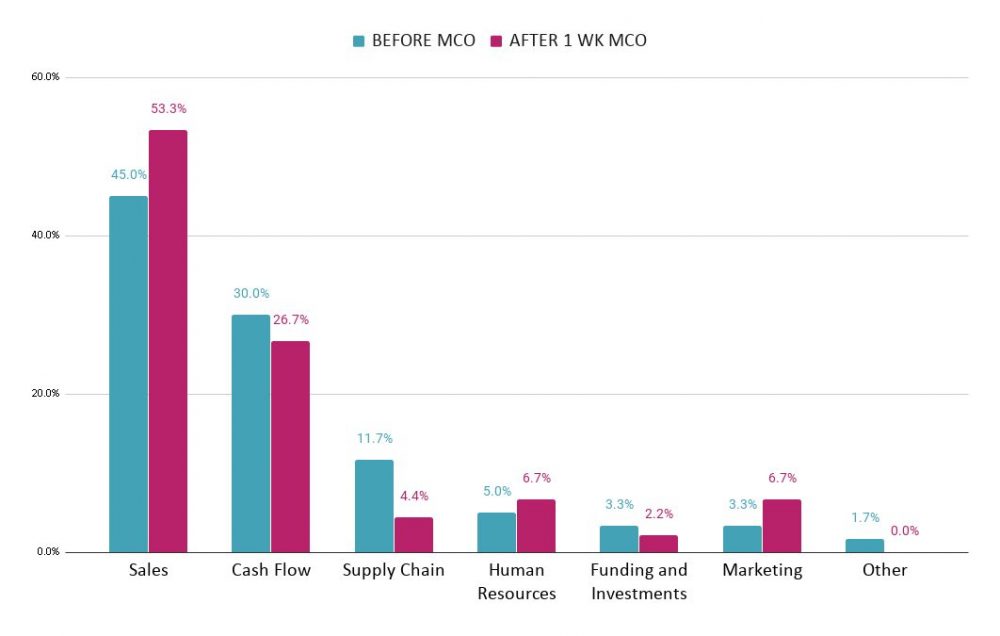

75% of SMEs cited sales and cash flow as the main area affected by COVID-19. As previously said, incoming requests have fallen drastically over the months.

Before the MCO

Local SMEs were worried somewhat about supply disruption. Once the MCO began, supply chain concerns shifted more to sales, as well as to human resources and marketing. For more than half of all SMEs, their primary concern is where their next sale will come from.

Cash flow was a primary concern for 30% of SMEs, due to the loss of jobs. Businesses that have confirmed projects may still receive payments, but one-off services like electricals works and plumbing may find their cash flow interrupted.

One Week Into the MCO

Although many of the services are categories under essential services, the loss in jobs and service requests have become more acute due to the movement restrictions imposed, where workers will be stopped at roadblocks, and denied entry to properties. Local suppliers have also shut their doors, forcing service professionals to reject even more business opportunities.

3. Business Outlook for the Rest of 2020

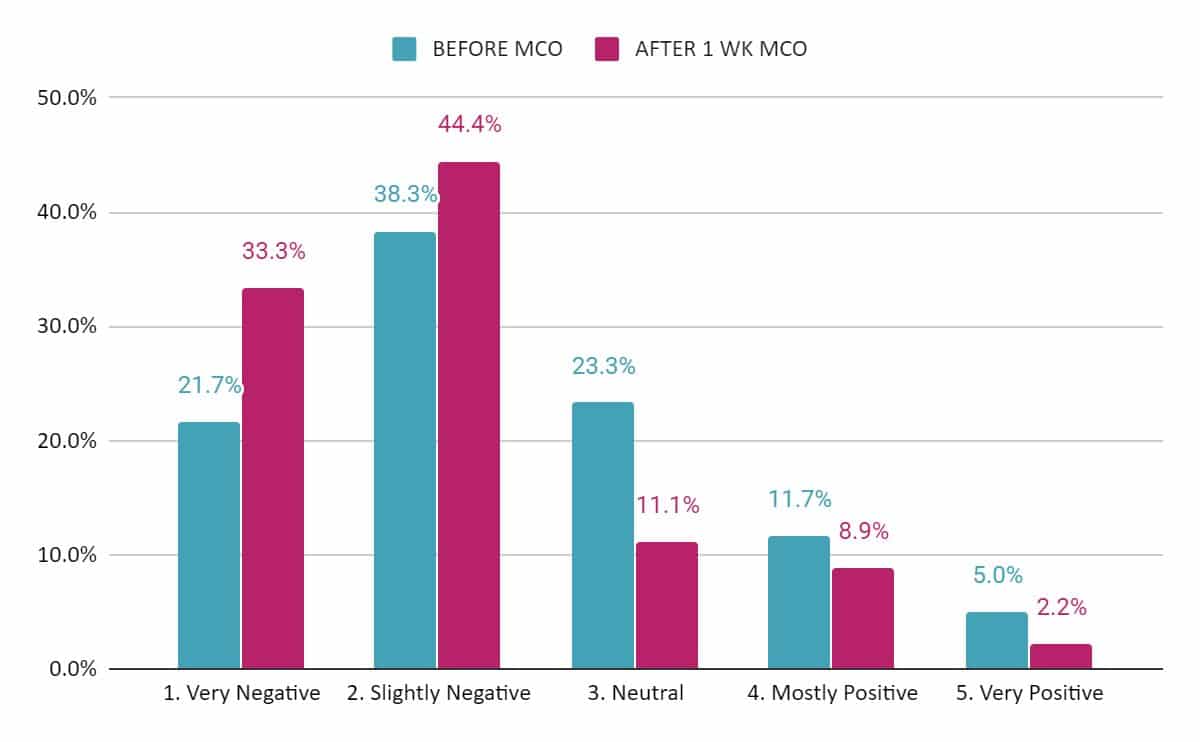

Before the MCO:

SMEs were already having a negative outlook for their business for the rest of 2020.

One Week Into the MCO:

The responses took a turn for the worse. Most companies were beginning to lose hope in recovering much with the impending downfall of the economy even after the restrictions are lifted.

4. Strategies to Keep the Business Running

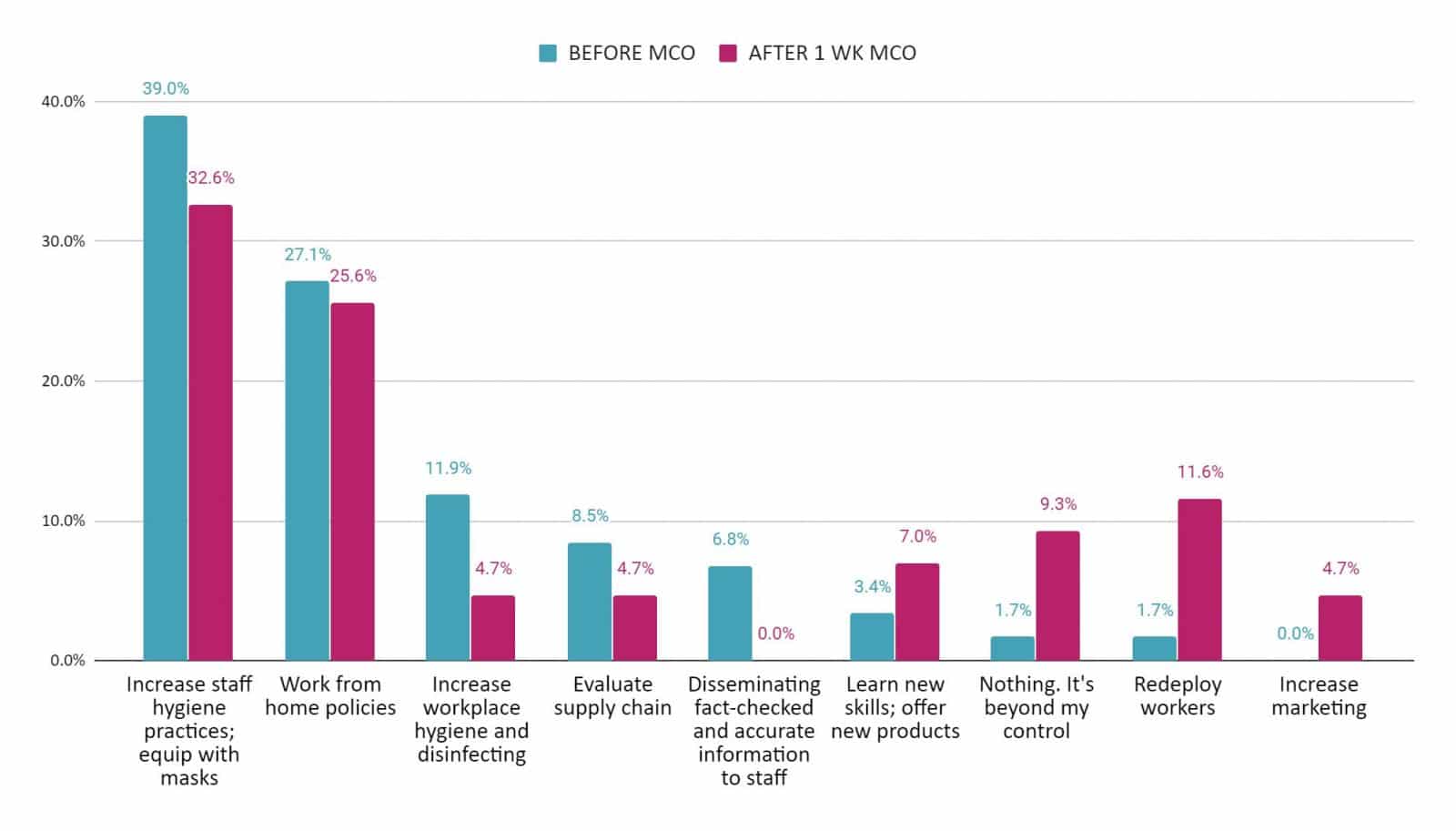

Before the MCO:

39% of companies focused on their staff’s hygiene care such as providing hand sanitisers and face masks. 27.1% implemented work from home policies to stay safe while continuing business operations.

11.9% focused on disinfecting their workplaces for those who come into work, and 8.5% were planning to re-evaluate their supply chains to keep supplies flowing. 6.8% felt that disseminating fact-checked information to their staff members would help.

One Week Into the MCO:

Strategies began changing. Initial strategies like improving staff hygiene, work from home policies, and workplace hygiene dropped slightly in importance. This is probably due to offices and work spaces being closed while the MCO is in effect.

Instead, more SMEs felt that the situation was beyond their control (9.3%), and 18.6% now feel the need to redeploy their workers, learn new skills and offer new products. Most workers can only work from home now, and it is important to be flexible enough to continue operating. Learning new skills, especially through the Internet, is now more crucial than ever.

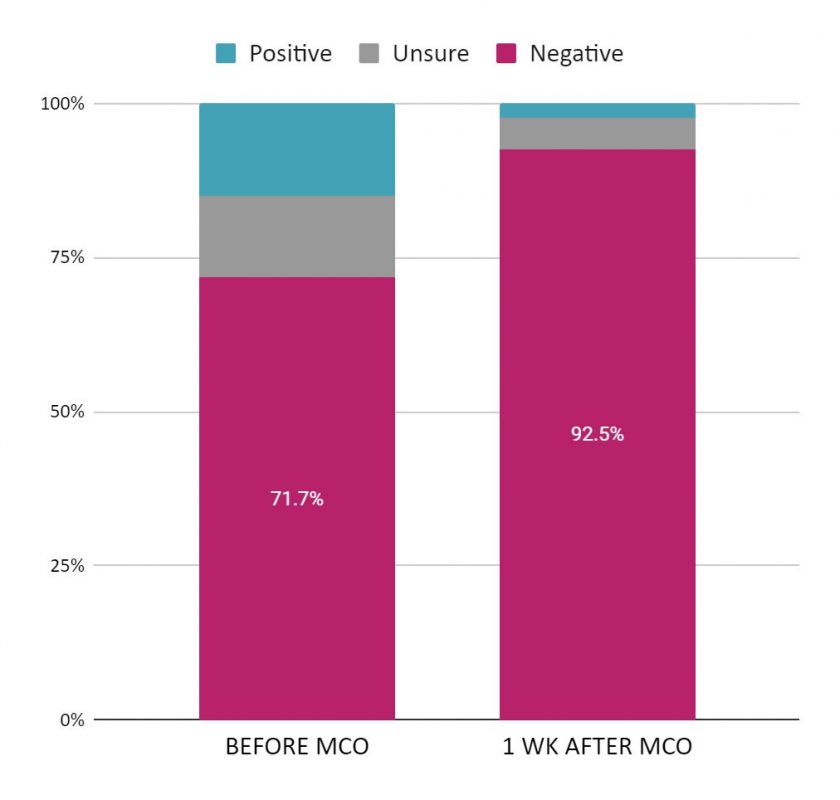

5. Economic Outlook for the Rest of 2020

Before the MCO:

71.7% of participants expressed a negative sentiment about the Malaysian economy at large for the rest of 2020.

One Week Into the MCO:

That percentage had increased to 92.5%. Comments include:

- “It’s trending downwards, possibly into a recession”

- “Downhill from here”

- “The economy will not grow”

- “Very unlikely to sustain”

- “I believe businesses will drop and lose profit”

Many also expressed their uncertainty of how the economy will progress, with many looking to the government for direction:

- “It will continue to go down unless the government finds a clear direction on how to deal with the issue”

- “With the new government right now, it’s a 50-50”

- “I don’t know because there are external factors like the new cabinet and government”

- “With the new government, only time will tell”

“[The Malaysian economy] will continue to go down unless the government finds a clear direction on how to deal with the issue”

SME respondent

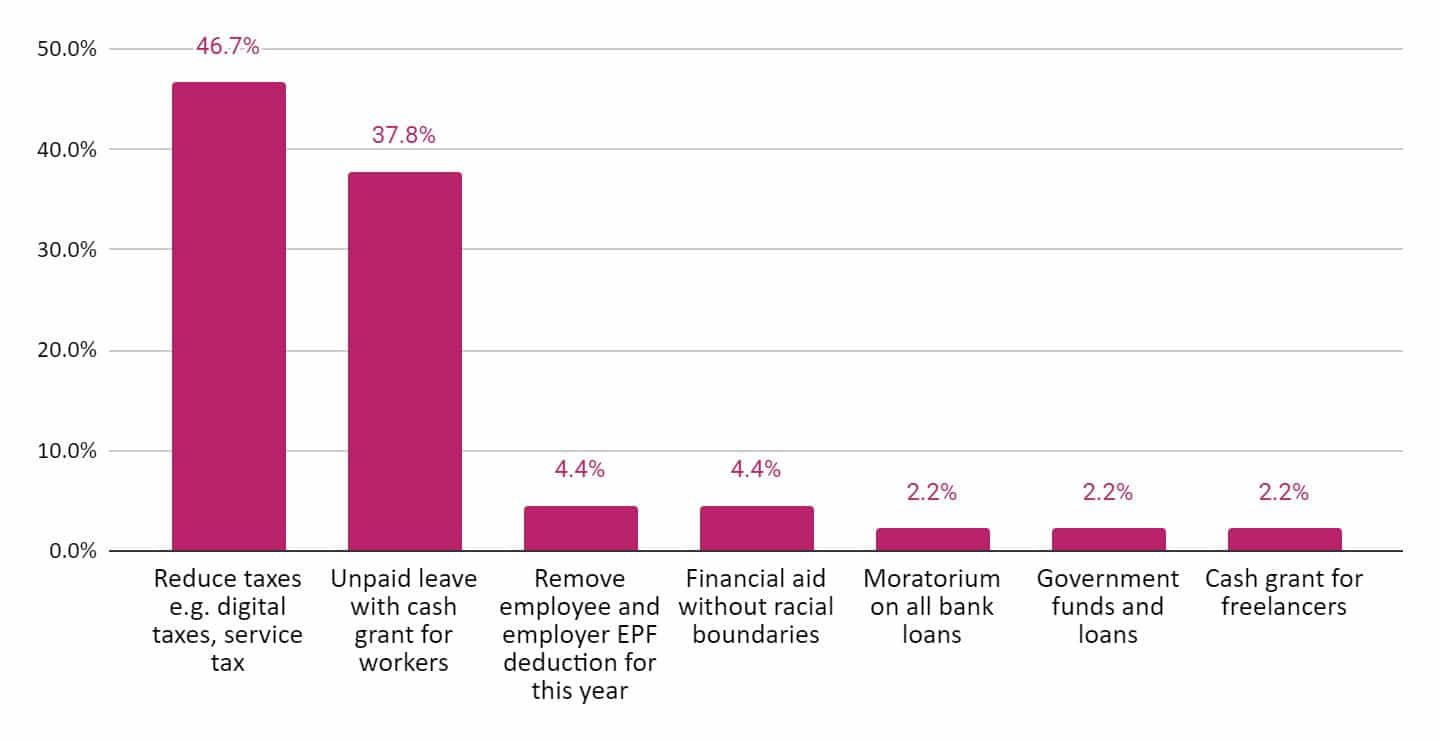

6. How the Government Can Help SMEs

When asked how the government can aid small business at this time, a vast majority (46.7%) stated reduced taxes such as digital tax and service tax would be of great help. 37.8% requested cash grants for workers who had to take unpaid leave in order to cope.

8.9% suggested cash grants or any type of financial aid for businesses that are still operating. Others stated removing employee and employer EPF deductions (4.4%) in the meantime and few suggested a 6-month moratorium on all bank loans (2.2%).

With SMEs and small businesses struggling to find means of earning anywhere, the one takeaway from this is for the government to aid them financially. Most recently, the Malaysian government announced a six-month moratorium on loan repayments and the restructuring of outstanding credit card balances, starting April 1.

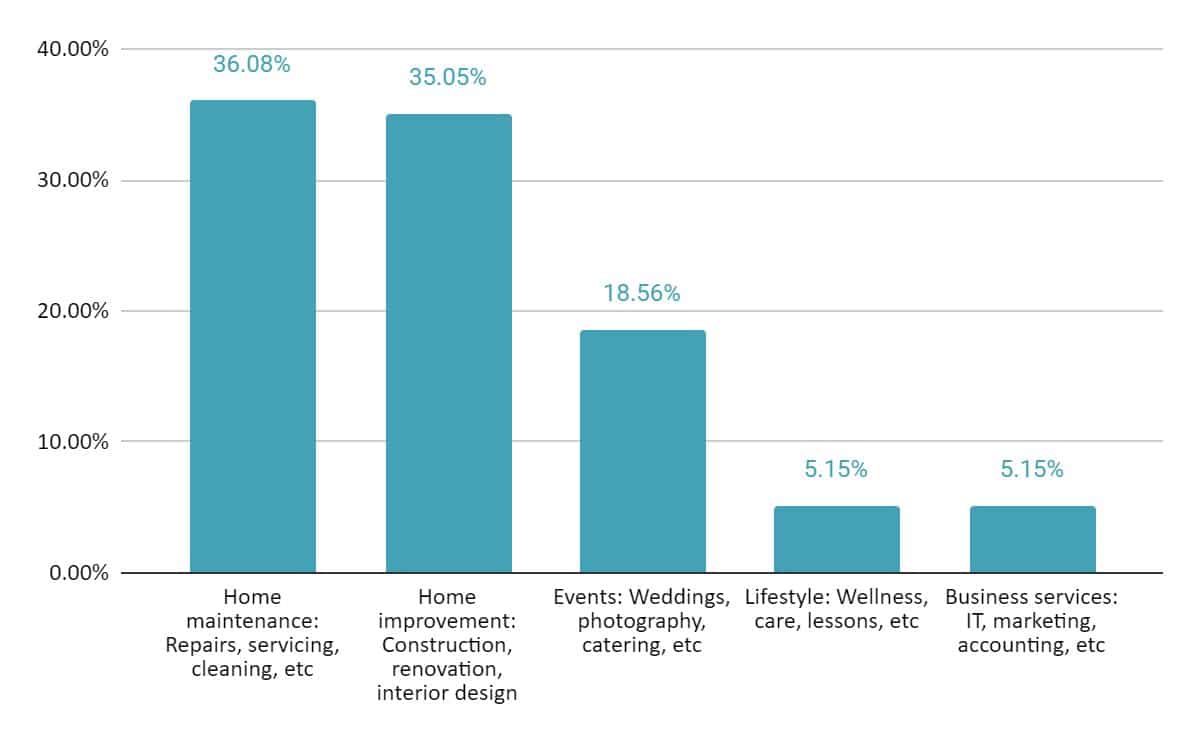

About this survey

This survey was conducted among 97 service-based, small-to-medium sized enterprises (SMEs) in Malaysia. Two rounds of surveys were conducted. The first was before the movement control order (MCO) was enacted on 18 march 2020, and the second round 1 week after the MCO.

Industries

Majority of the participants are made of home maintenance companies at 36.08%, followed closely by home improvement companies at 35.05%. The rest is made up of event-based companies at 18.56%, business services at 5.15%, and lifestyle-based services with 5.15%. Some of them are active users of the Recommend.my home services platform, but the majority are from the wider business community that the survey was shared with.

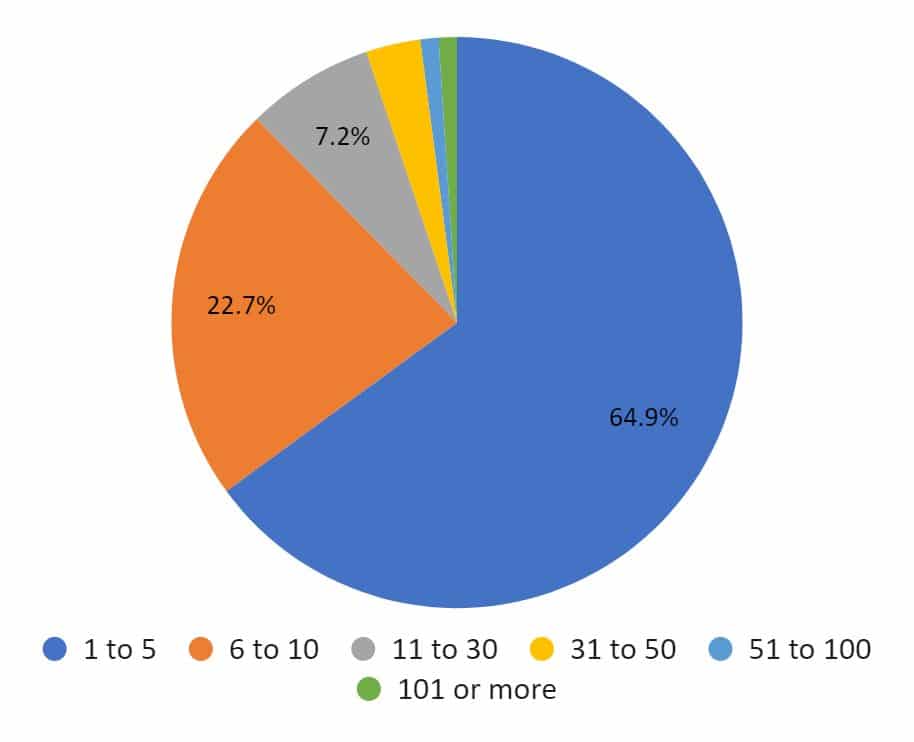

Company size

The majority of SMEs surveyed consist of 10 employees or less, making up 87.6% of all respondents.

About Recommend.my

Recommend.my is Malaysia’s leading Home Services platform, established in 2014. Thousands of service professionals use our platform to receive bookings and quotation requests for jobs including cleaning, disinfection, plumbing, electrical, aircon servicing, renovations,handyman services, interior design and more. To date, the service professionals on our platform have served hundreds of thousands of customers, homeowners, and businesses in Malaysia.

Learn more:

- Visit Recommend.my

- Contact our PR division at [email protected]